Digital Money for We the People (Extended Version)

Gold money can be up and running quickly. Stock-based money will ultimately add the most value.

James Anthony

March 21, 2023

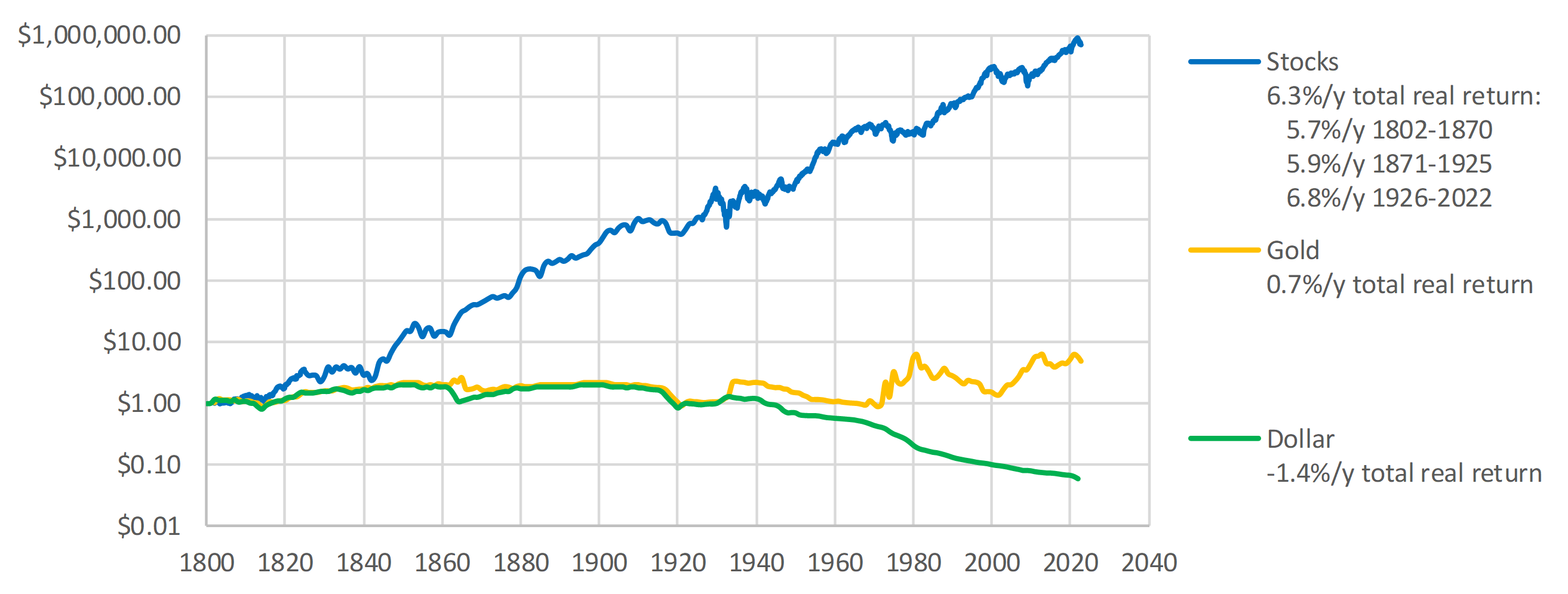

Data: Stocks 1802-1825 [1], 1826-1925 [2] with the lower-bound returns for 1826-1870 adjusted upwards in proportion to the Cowles return for 1871-1925, and 1926-2022 [3]. Gold 1802-2015 [4] and 2016-2022 [5]. Dollar per CPI [6].

Figure: Dollars lose value. Gold money can conserve value. Stock-based money will add value [7].

Money production has been monopolized by governments everywhere, but even so, money is just another product. Under governments’ monopolies, innovation to satisfy the customers for money products has stagnated, and the quality of money products has just kept getting worse [8].

Lately, digital government money [9] gets attention from all the usual suspects. Progressive governments want their crony-socialist banks to expand the governments’ power over the people. Digital government money threatens to be a key tool to further deprive persons of secure property, liberty to move and work and buy, and lifesaving health treatments.

Fortunately, though, in the USA, government monopolization of money is unconstitutional. The Constitution merely authorizes the national government to produce precious-metal coins and to regulate what weight of precious metals is treated as being present in each coin from each producer. The Constitution doesn’t empower governments to force people to accept government money [10] or to force people to not use other moneys. Above all with respect to money, the Constitution requires that no person shall be deprived of the liberty [11] to produce better moneys or to use these better moneys.

Digital money for the people needs attention from We the People. Private money producers can offer us money that will gain purchasing power, will be stable from boom-bust cycles, and will help us add way-more value.

Value-Conserving Gold Money

The first two gains, in purchasing power and economic stability, would be possible with digitally-handled gold money.

Gold money’s purchasing power gains would come because discovery and mining gold is costly, so the world’s quantity of gold grows slowly [12], and governments can’t inflate this quantity faster. Meanwhile, usage would grow faster. The population using gold money would grow faster, and would add value proportionately faster. Producers also naturally grow more productive and would add value even faster. The net result would be that gold money’s purchasing power would again gradually increase [13], like it did in the 1800s between wars.

Gold money’s economic stability would come from being backed by 100% reserves [14]. Gold money backed by 100% reserves couldn’t be created out of thin air [15]. Since its quantity could increase only slowly and its purchasing power would increase faster, it couldn’t cause the same large boom-bust cycles [16].

Handling gold money digitally would bypass any need for in-person handling of physical gold or even of physical warehouse receipts [17].

Most money payments are already handled digitally by systems comprised of sellers, seller interfaces, payment processors, buyer interfaces, and buyers [18]. Payments backed by 100%-reserve balances of physical gold can already be arranged digitally using MasterCard as the seller interface and payment processor and using Glint [19] as the buyer interface.

Glint balances are in warehoused physical gold, and many countries don’t treat gold as money, so these features add costs. Small fees for warehousing and bookkeeping are unavoidable. But the fee for exchanging the physical gold for government money [20] and the taxes on capital gains on gold holdings [21] could both be driven to zero [22].

Past economic shocks [23] have brought rapid growth in other financial innovations [24]. Growth could be coming soon to gold money handled digitally.

Value-Adding Stock-Based Money

All three gains from digital money for the people—in purchasing power, economic stability, and added value from investing the money’s stored value—will ultimately come from using digitally-handled stock-based money.

The purchasing power of stock-based money will grow as the population grows, as people grow more productive, and as the underlying stocks grow in value.

The economic stability of stock-based money will come from the fact that stock-based money will be actual ownership of productive assets, which can’t be created out of thin air, so stock-based money will be stable; it won’t cause boom-bust cycles.

(Note that boom-bust cycles have long been produced by unstable, inflated government money, and have long caused significant short-term losses in stocks. Such economic-cycle-driven temporary losses in stocks’ purchasing power will become a relic of the past once the money that’s in widespread use can’t be inflated.)

The eventual move to stock-based money could be speeded up if people would first transition to gold money backed by 100% reserves. This transition step would quickly free us from government money, bringing stability. On the other hand, this transition step might not even be necessary.

Many people, by investing directly in mutual funds, or by having pension plans, already allocate significant portions of their holdings to stocks, to earn stocks’ superior long-run returns [25]. Some of these savvy investors will gladly be the first adopters of stock-based money.

Stock-based money will end up substantially increasing the overall investments in the underlying companies, and these companies will produce substantial increased value for customers. Once all money is stock-based money, the total investment in all companies will have doubled [26].

To gain the full potential from this doubled investment, this investing must be done well. This will require that enough individuals choose their own portfolios. Here’s how this will work best.

Before I buy a product, I will have my stock-based-money balance invested in my custom portfolio, and the seller will have his stock-based-money balance invested in his custom portfolio. I will sell a fraction of my custom portfolio that has the same value as the product’s price, and buy a fraction of all the world’s publicly-traded stocks that has this same value. I will transfer these stocks to the seller. The seller will sell these stocks and will buy for his custom portfolio a fraction of stocks that has this same value.

The common unit in which products are priced will be a prespecified fraction of the world’s publicly-traded stocks; say, a femtoshare (a 10-15 share). But for all the people who keep their stock-based money in custom portfolios, such femtoshares will be bought only momentarily to transfer value from buyer to seller and then will be immediately sold. These people’s actual stock-based money will be their custom portfolios. This money will grow in value.

Buyers or sellers who don’t want custom portfolios will hold their stock-based money balances as femtoshares. This money will also grow in value, exactly as fast as the world’s overall stock-market capitalization would grow.

Money is exchangeable [27] stored value [17]. Money must not be an instrument of government tyranny. Our store of money must be an investment that yields people the best-possible returns.

Computing and communications have gotten vastly-more economical [28]. Using these advances to produce stock-based money will help us all add value dramatically faster.

References

- Schwert, G. William. “Monthly US Stock Returns, 1802-1925.” BillSchwert.com, 10 June 2021, www.billschwert.com/mstock.htm. Accessed 21 Mar. 2023.

- Goetzmann, William N., et al. “A New Historical Database for the NYSE 1815 to 1925: Performance and Predictability.” Journal of Financial Markets, vol. 4, no. 1, Jan. 2001, pp. 1-32.

- Shiller, Robert. “Online Data Robert Shiller.” Econ.Yale.edu, www.econ.yale.edu/~shiller/data.htm. Accessed 21 Mar. 2023.

- “Historical Gold Prices.” OnlyGold.com, onlygold.com/gold-prices/historical-gold-prices/. Accessed 21 Mar. 2023.

- “Gold Price: London Fixing.” NASDAQ, data.nasdaq.com/data/LBMA/GOLD-gold-price-london-fixing. Accessed 21 Mar. 2023.

- “Consumer Price Index, 1800-.“ MinneapolisFed.org, www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/~/link.aspx?_id=6B3D5F1A7693433B848396E517007B3F&_z=z. Accessed 21 Mar. 2023.

- Anthony, James. “2022 Total Real Returns of Stocks, Gold, and Dollars for 1802-2022.” onedrive.live.com/edit.aspx?resid=9A4638E75DFAC37D!425681&ithint=file%2cxlsx&wdLOR=cB5F602DB-8CA5-4ADF-8744-2C46AA42644D&authkey=!AO5A1suQjyhz2Zs. Accessed 21 Mar. 2023.

- Anthony, James. “Fed Socialist Money Manipulation Cancels Individuals’ Better Judgment.” Mises Wire, 15 Oct. 2022, mises.org/wire/fed-socialist-money-manipulation-cancels-individuals-better-judgment. Accessed 21 Mar. 2023.

- Hansen, Kristoffer Mousten. “Central Bank Digital Currency: A Primer.” Mises Wire, 28 Dec. 2020, mises.org/wire/central-bank-digital-currency-primer. Accessed 21 Mar. 2023.

- Hulsmann, Jorg Guido. “Legal Tender Laws and Fractional-Reserve Banking.” Journal of Libertarian Studies, vol. 18, no. 3, Summer 2004, pp. 33-55.

- Anthony, James. “On the Reading of Old Constitutions.” rConstitution.us, 9 Oct. 2020, rconstitution.us/on-the-reading-of-old-constitutions/. Accessed 21 Mar. 2023.

- “Gold: Production.” Wikipedia, 20 Mar. 2023, en.wikipedia.org/wiki/Gold#Production. Accessed 21 Mar. 2023.

- Salerno, Joseph T. “An Austrian Taxonomy of Deflation—with Applications to the U.S.” Quarterly Journal of Austrian Economics, vol. 6, no. 4, Winter 2003, pp. 81-109.

- Fuller, Edward W. “100% Banking and Its Advocates: A Brief History.” Mises Wire, 23 Oct. 2019, mises.org/wire/100-banking-and-its-advocates-brief-history. Accessed 21 Mar. 2023.

- Werner, Richard A. “A Lost Century in Economics: Three Theories of Banking and the Conclusive Evidence.” International Review of Financial Analysis, vol. 46, July 2016, pp. 361-79.

- Byland, Per L. How to Think about the Economy: A Primer. Mises Institute, 2022, pp. 105-19.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 98-124.

- DeGennaro, Ramon P. “Merchant Acquirers and Payment Card Processors: A Look inside the Black Box.” Economic Review, vol. 91, no. 1, First Quarter 2006, pp. 27-42.

- “How Glint Works.” GlintPay.com, glintpay.com/en_us/glint/how-glint-works/. Accessed 21 Mar. 2023.

- Alcantara, Billy. “What Are the Glint Fees & Limits?” GlintPay.com, 21 June 2021, glintpay.com/en_us/faqs/what-are-the-glint-fees-limits/. Accessed 21 Mar. 2023.

- Anthony, Craig. “Taxes on Physical Gold and Silver Investments.” Investopedia, 31 Dec. 2021, www.investopedia.com/articles/personal-finance/081616/understanding-taxes-physical-goldsilver-investments.asp. Accessed 21 Mar. 2023.

- Sound Money Defense League. Sound Money Index 2023. Money Metals Exchange, 2022.

- Lahiri, Amartya. “The Great Indian Demonetization.” Journal of Economic Perspectives, vol. 334, no. 1, Winter 2020, pp. 55-74.

- Crouzet, Nocolas, et al. “Shocks and Technology Adoption: Evidence from Electronic Payment Systems.” Kellogg.Northwestern.edu, Jan. 2023, www.kellogg.northwestern.edu/faculty/crouzet/html/papers/TechAdoption_latest.pdf. Accessed 21 Mar. 2023.

- Siegel, Jeremy J. Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies. 4th ed., McGraw-Hill, 2008, pp. 3-7.

- Anthony, James. “Productive Property Adds Value for Everyone.” rConstitution.us, 20 Nov. 2020, rconstitution.us/productive-property-adds-value-for-everyone/. Accessed 21 Mar. 2023.

- Byland, Per L. How to Think about the Economy: A Primer. Mises Institute, 2022, pp. 67-81.

- Tardi, Carla. “What Is Moore’s Law and Is It Still True?” Investopedia, 17 July 2022, www.investopedia.com/terms/m/mooreslaw.asp. Accessed 21 Mar. 2023.

James Anthony is an experienced chemical engineer who applies process design, dynamics, and control to government processes. He is the author of The Constitution Needs a Good Party and rConstitution Papers, the publisher of rConstitution.us, and an author in Daily Caller, The Federalist, American Thinker, American Greatness, Mises Institute, and Foundation for Economic Education. For more information, see his media and about pages.

Commenting

- Be respectful.

- Say what you mean.

Provide data. Don’t say something’s wrong without providing data. Do explain what’s right and provide data. It’s been said that often differences in opinion between smart people are differences in data, and the guy with the best data wins. link But when a writer provides data, the writer and the readers all win. Don’t leave readers guessing unless they go to links or references. - Credit sources.

Provide links or references to credit data sources and to offer leads.