The Forgotten Customers

Customers provide the supervisory control that makes the system of voluntary cooperation work best, because customers drive producers to do their best.

James Anthony

November 4, 2022

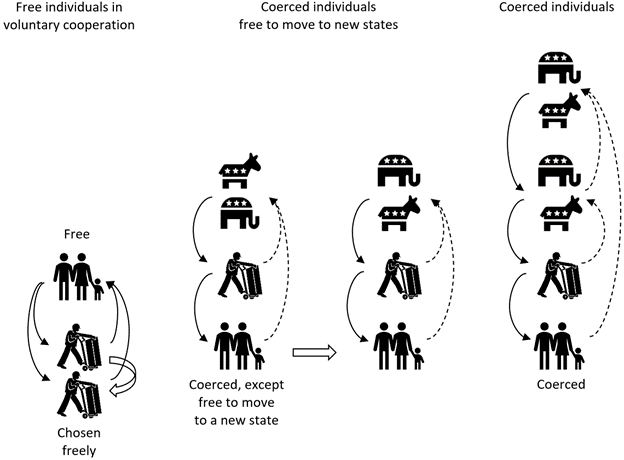

Information flows, shown as solid where strong and dashed where weak, are depicted for voluntary cooperation, state-government interventionism, and national-government interventionism:

- In voluntary cooperation, customers control producers by choosing freely between producers.

- Under state-government interventionism, state governments control producers, and customers are coerced but are still free to move to new states.

- Under national-government interventionism, the national government controls state governments, state governments control producers, and customers are coerced.

Figure: Interventionalist governments take away customers’ control [1].

“The Forgotten Man” described by William Graham Sumner is the taxpayer, who politicians gang up on to force him to do certain things for the politicians’ cronies [2]. The forgotten customers focused on in this article are all of us, who politicians and their cronies gang up on to take away all kinds of our choices.

Forgotten taxpayers lose some of their property. Forgotten customers lose their supervisory control over producers; and then everyone loses out on the considerable, constantly-compounding value that would otherwise be added by customers and by the producers that customers regulate.

As Ludwig Von Mises described in Bureaucracy [3] (and discussed more-fully in Human Action [4]):

The real bosses, in the capitalist system of market economy, are the consumers. They, by their buying and by their abstention from buying, decide who should own the capital and run the plants. They determine what should be produced and in what quantity and quality.

… Thus the capitalist system of production is an economic democracy in which every penny gives a right to vote. The consumers are the sovereign people.

In The Mises University Reader, which uses key researchers’ own words to introduce key concepts in Austrian economics, many, many passages attest to the key role of customers, across all 12 readings [5]:

- From the birth of Austrian economics by Carl Menger, “Menger was motivated by the specific and overarching aim of establishing a causal link between the subjective values underlying the choices of consumers and the objective market prices used in the economic calculations of businessmen.” “[T]he subjective and nonquantifiable valuations and preferences of the consumer” are “the raison d’être of all economic activity.” Producer products are only as valuable as these products’ contributions, as inputs, to the value of consumer products [6].

- Fundamentally, individuals engage in conscious actions towards goals. Producers’ actions can advance towards producers’ goals only to the extent that the producers’ actions advance customers towards customers’ goals [7].

- Customers’ choices to buy products now or later, and to buy one product now rather than another product, establish which products will best meet customers’ goals now and in the future [8].

- It is in service of their goals as customers that people, in their complementary roles as producers, choose to produce, and choose to perform the work that other customers decide is doing the most to meet these other customers’ goals [9].

- Money, which makes voluntary exchanges far-more convenient, is itself a product that’s used by customers. Customers hold money balances to position themselves to choose products later if they turn out to need or want these products later, given that due to various uncertainties now, they can’t be sure now whether or not they will need or want various products; or when they do need or want products, exactly which products they will need or want [10].

- Banking, which is a general term that gets used to describe both money warehousing and money lending, is another product used by customers. Customers use banking to hold balances of their own money, to borrow balances of other customers’ money, and to facilitate selling and buying products by exchanging them for money [11].

- Entrepreneurs’ actions shape the structure of the production processes, creating all capacity and production. Entrepreneurs’ special skill is to anticipate the future desires of customers (and to anticipate the future states of competing entrepreneurs) [12].

- Austrian capital theory reinforces that the cause of all producers’ actions is the satisfaction of customers. All value of resources and all value of producer actions is derived from the value of the final products to customers [13].

- Interest exists because customers vary in the timing they prefer for their purchases. Some customers are more willing to delay some of their purchases than other customers are willing to delay their purchases. Producers also need to make purchases now to develop future production. Money loans are products that exist because of these differing preferences of customers and this need of producers. The actions of customers and producers are the proper determinants of the rates of interest [14].

- A monopoly has been said to exist when customers don’t remain in supervisory control because instead a producer or cartel exerts supervisory control over a product’s supply; or a producer or cartel exerts supervisory control over at least one input; or a government exerts supervisory control over producers [15].

- Under socialism, governments control investments and wages independently of customers’ valuations of final goods. When socialism exists as islands amidst freer human action, then socialists can crib the customer-derived prices of producer goods from other regions. But under global socialism, governments could only direct action using political decisionmaking processes, because they would have blinded themselves to the dynamically-adapting information about final customer wants and needs that, in free-market economies, is conveyed through prices back through all producer goods, all the way back to the raw-material deposits [16].

- Under the Austrian theory of the business cycle, governments decouple the supply of money loans from the supply of customer savings. Governments inevitably loan more money than customers save and will spend in the future, so producers inevitably invest in capacity to produce more products than customers will eventually buy [17].

Against this backdrop, it makes sense to question Mises’s assertion, quoted in the reader [18], that entrepreneurs provide “the driving force of the market [19].” Also, to qualify D. T. Armentano’s remark, quoted in the reader, that, like customers, entrepreneurs “are also sovereign under free-market conditions [20].” And to question Murray Rothbard’s assertion, quoted in the reader, that entrepreneurs are “fooled by the government-and-bank intervention in the loan market [21].” None of these things may be quite as they seem. Here’s why.

Entrepreneurs are seeking every possible advantage. Even entrepreneurs who consider that they might be in a boom might well reckon that they are better off competing to build or maintain production capacity [22] throughout booms and then also competing to work around any resulting losses during busts. If so, then entrepreneurs, for all their driving force, and despite being sovereigns over their own actions, are not clearly taking foolish actions when they work to develop advantages over their competitors even in times of booms. But entrepreneurs clearly are being pushed around by governments and banks.

Clearly, then, in interventionist economies, governments and banks are the strongest driving force. By analogy, then, as well as for the wealth of reasons outlined above, if customers had not been pushed aside, then customers would be the strongest driving force.

Government people and their cronies, for their part, are intimately aware of who are their greatest rivals. Their greatest rivals are the people they incessantly gang up on to overpower: above all, customers [23], [24].

When they do, we all suffer. Because rightfully, in the best interests of everyone in the long run, the controlling sovereigns—the kings—are customers [25].

References

- Anthony, James. rConstitution Papers: Offsetting Powers Secure Our Rights. Neuwoehner Press, 2020, pp. 12.5-16.

- Sumner, William Graham. What Social Classes Owe Each Other. 1883. The Caxton Printers, 1974, pp. 107-131.

- Mises, Ludwig von. Bureaucracy. Yale University Press, 1941, pp. 20-1.

- Mises, Ludwig von. Human Action: A Treatise on Economics. 1949. Ludwig von Mises Institute, 1998, pp. 270-3.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 5-33.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 34-61.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 62-87.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 88-97.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 98-124.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 125-57.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 158-66.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 167-82.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 183-203.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 204-25.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 226-39.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, pp. 240-61.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, p. 158.

- Mises, Ludwig von. Human Action: A Treatise on Economics. 1949. Ludwig von Mises Institute, 1998, p. 325.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, p. 224.

- The Mises University Reader, compiled by Jonathan Newman, Ludwig von Mises Institute, 2022, p. 255.

- Gilbert, Richard J., and Marvin Lieberman. “Investment and Coordination in Oligopolistic Industries.” The RAND Journal of Economics, vol. 18, no. 1, Spring 1987, pp. 17-33.

- Rothbard, Murray N. The Progressive Era. Edited by Patrick Newman, Mises Institute, 2017.

- Shaffer, Butler. In Restraint of Trade: The Business Campaign against Competition, 1918-1938. 1997. The Ludwig von Mises Institute, 2008.

- Anthony, James. “Socialism Kills Freedom.” rConstitution.us, 26 Mar. 2021, rconstitution.us/socialism-kills-freedom/. Accessed 16 Sep. 2022.

James Anthony is the author of The Constitution Needs a Good Party and rConstitution Papers, publishes rConstitution.us, and has written in Daily Caller, The Federalist, American Thinker, American Greatness, Mises Institute, and Foundation for Economic Education,. Mr. Anthony is an experienced chemical engineer with a master’s in mechanical engineering.

Commenting

- Be respectful.

- Say what you mean.

Provide data. Don’t say something’s wrong without providing data. Do explain what’s right and provide data. It’s been said that often differences in opinion between smart people are differences in data, and the guy with the best data wins. link But when a writer provides data, the writer and the readers all win. Don’t leave readers guessing unless they go to links or references. - Credit sources.

Provide links or references to credit data sources and to offer leads.