Productive Property Adds Value for Everyone

Assets that are productive underpin all added value, innovation, and wealth.

James Anthony

November 20, 2020

The battle for sound money is in the news often, with Fed candidates mentioning returning to a gold standard, with the Chinese and Russian governments buying gold, and with cryptocurrencies being seen as potentially bypassing government restrictions [1].

But even sound-money advocates are missing the larger picture. Gold and cryptos fall far short of being the best store of value in terms of productivity, total value, and irreplaceability.

Gold and cryptos just sit in vaults or on servers doing nothing. Investments in company shares, on the other hand, add to the voluntary economy’s capital and get put to work adding more value. As a result, as financial advisors know very well, these equities provide long-term investment returns that are far superior [2].

And since investments in company shares are put to work, equity-based money would have two side benefits that gold and cryptos could never match.

Unlike gold and cryptos, company shares have an existing value that’s at least an order of magnitude more massive—as we’ll see shortly, their existing value is comparable to the total value of the money that’s currently outstanding. Equity-based money would therefore be a store of value that’s intrinsically far larger and more stable.

And unlike gold and cryptos—which, as we’ve seen already with gold, could be outlawed as money without crippling the voluntary economy—company shares are irreplaceable. Company shares can’t be outlawed without eliminating the natural selection of capital investment that fuels the voluntary economy and that helps the voluntary economy evolve. Governments can’t outlaw company shares without moving their nation’s economies out of contention in the world economy.

These key broad considerations about what’s the best future money are part of an even-broader picture of what are the best assets to hold.

In this picture, government people have made themselves key players. Government people exert unavoidable influence both through the controls that government people exercise over individuals’ decisions and through the assets that government people control directly.

As a result, much good can be done by making government people more-fully aware of the opportunities they have to let people add more value.

Government people improve economic well-being when they help people shop freely and produce freely.

An unappreciated, key way that government people can help people cooperate with one another freely is to simply let people change which assets they hold.

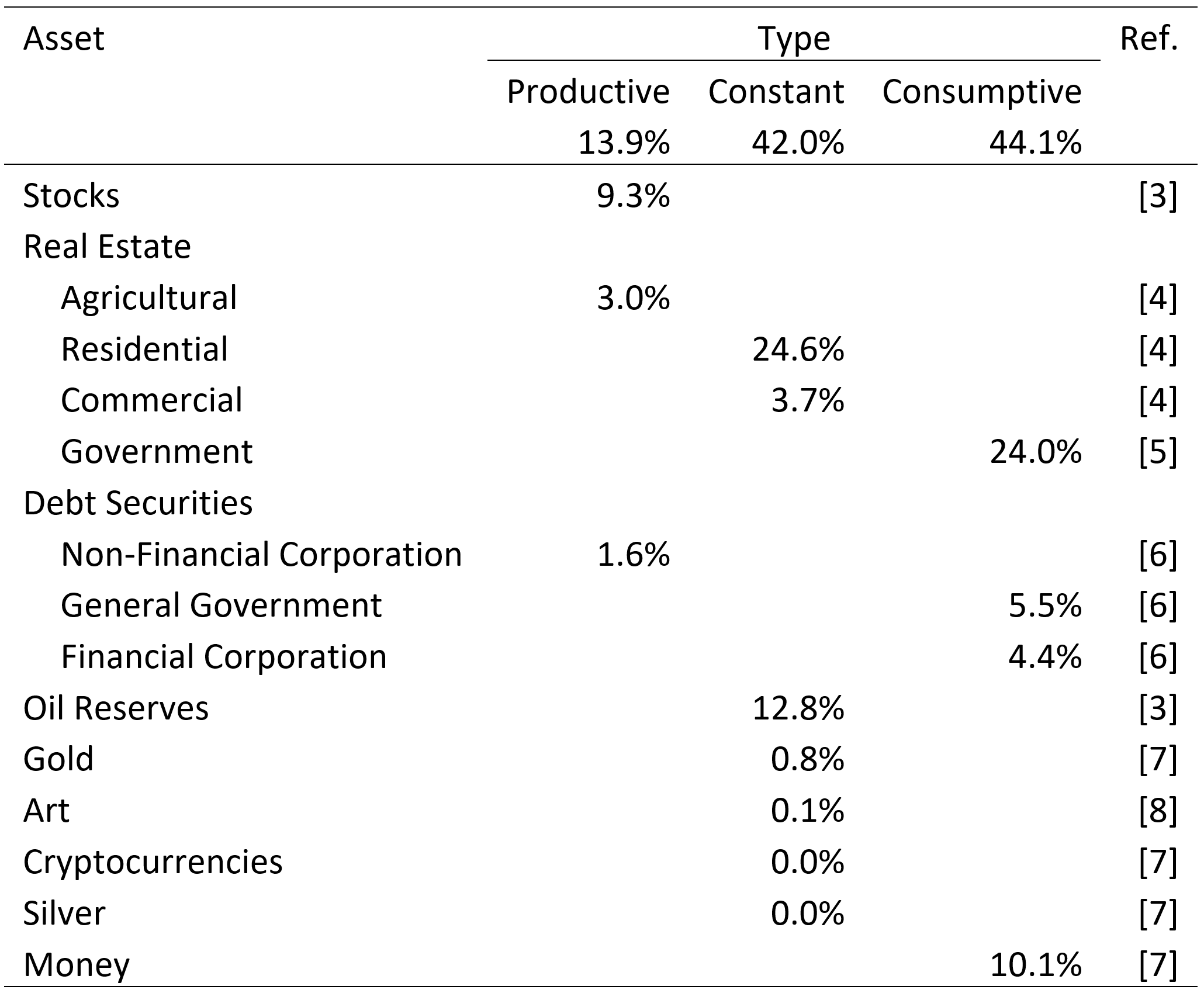

The assets held by the world’s people can be categorized as productive (value adding), constant (value maintaining), or consumptive (consumption enabling), as shown in the accompanying table.

Table. World Wealth Percentages by Asset Type [3], [4], [5], [6], [7], [8]

Productive Assets Add Value for Everyone

Company shares, farm land, and company bonds are assets that are productive.

Productive assets are force multipliers. They enable farmers to use machinery, workers to run plants, and designers to improve processes.

Producers have diverse opportunities to increase productivity and optimize quality, features, and delivery.

Customers control what quality and features sell, at what price, and in what quantity. Ultimately, customers control which producers get to use more resources and which producers have to shut down.

Customers, and the producers they control, add value for everyone:

- Customers buy products only when products deliver more value than customers’ money would buy elsewhere.

- Producers earn some of the value generated by customers and producers.

- Customers buy other products that also deliver more value because they also make use of a given product’s innovations.

- Producers make these other products and gain some of this spillover value.

- Government people grab the rest.

Productive assets are the only assets that drive value creation. Businesspeople in cities and regions use productive assets to produce the products that people in various cities and regions specialize in. Investments in productive assets determine how much value people generate, which determines how much abundance spills over into constant assets and consumptive assets.

Constant Assets Hold Value for Owners

Residential real estate and commercial real estate provide value to owners that offsets these assets’ slow depreciation. Over time, these assets’ purchasing power—their value—is approximately constant.

Other constant assets are oil reserves, gold, works of art, cryptocurrencies, and silver.

Constant assets can gain or lose value as a result of external factors. Real estate gets artificially scarcer when crony owners collude with government people to limit other owners’ freedom to improve land. Great cities’ real estate, and great works of art, attract more wealth when more wealth is produced. Oil reserves are more valuable when government people make supply riskier, but are less valuable when new technologies like fracking increase total reserves. Constant assets that are smaller in total value are affected more by speculation.

The defining feature of constant assets is that their value isn’t changed by their owners. Their value is determined by other people’s actions, particularly other people’s innovations using productive assets.

Consumptive Assets Destroy Value for Everyone

Boston’s Logan Airport, Chicago’s public schools, and Monterey, California’s Army and Navy schools are government grabs of real estate.

In these city hubs and this beautiful coastland, businesspeople would compete to best help people work together and live together, providing greater value to everyone.

By blocking businesspeople from providing workspaces and living spaces in prime locations, government people actively destroy great value, the same as if they constantly reserved plane seats or hotel rooms, never showed up, and never paid a dime. Substantial value that could have been produced gets destroyed and gone forever, year after year. Government real estate is consumptive on a massive scale.

Government money, a second consumptive asset type, enables government people to finance more domestic spending and war by inflating the quantity of government money.

This money-quantity inflation makes the government money’s purchasing power evaporate. From 1941 to 2020, government people’s inflation of the quantity of money caused the dollar’s purchasing power to plummet by 95% [9].

Government people’s inflation of the quantity of government money consumes the purchasing-power value of any account balances people have whose values are tied to the value of government money.

Government debt securities, a third consumptive asset type, are issued directly by government people or are issued indirectly by financial corporations chartered by government people.

Government debt securities are denominated using government money whose purchasing-power value is partly consumed by government people’s inflation of the quantity of money. Before long, though, the remaining purchasing power also gets consumed.

Government debt securities fund government people’s taking of property from future voters and giving this property to donors and to favored present voters, violating future voters’ constitutionally-protected property rights. Some of the seized property is used to pay the government people and is consumed. Some of the seized property is given to donors and to favored present voters and is consumed.

Government debt securities also fund undeclared wars and a supersized military. Both are unconstitutional. Here too, some property is unconstitutionally seized from future voters and is consumed.

Satisfying cronies, including favored present voters, is a powerful incentive. Long ago, it incentivized the national-government people to form the first national-government bank, the original violation of the Constitution [10].

The better way is freedom.

Smaller Government Helps People Add More Value

Government people coerce us whenever they use consumptive assets. This means that when consumptive assets are minimized, freedom increases.

Productive assets create options for businesspeople to add value for everyone and to innovate. When savings are shifted from consumptive to productive assets, freedom greatly increases.

One shift in the right direction is to sell prime government real estate and relocate these few government people and airplane passengers to locations that are economical. This will greatly shrink the ongoing destruction of these scarce resources that have alternative uses. This will greatly enhance network effects in cities and regions, will appropriately disempower government people, and will shift up to 24% of world assets from consumptive to constant.

A second shift in the right direction is to freely allow alternative moneys.

Gold and silver are the only moneys the USA government people constitutionally have power to issue. Gold’s and silver’s full legality as money should be explicitly confirmed by repealing unconstitutional statutes that impede their use as money and that protect inferior paper money. Spread worldwide, this would significantly limit government people’s coercive power to destructively spend by inflating government money. In the process, this would shift 10% of world assets from consumptive to constant.

Stocks, though, are the ultimate private money. Stocks are ownership of the world’s publicly-traded companies, including all of these companies’ products, equipment, land, employment contracts, processes, and relationships. The enabling technologies needed for stock-based money all exist now. Stock-based money will instead shift 10% of world assets all the way from consumptive to productive.

A third shift is to eliminate government and financial-corporation debt securities. Freed up, the additional 10% of world assets that’s currently held in these debt securities would also shift from consumptive to productive.

Altogether, these three changes would eliminate all assets that are consumptive and would increase the proportion of assets that are productive from 14% to 34%, increasing the proportion of assets that are productive by a factor of 2.4!

The exponential growth from this dramatically-larger base level of investment would far outpace anything we’ve seen before.

Customers and businesspeople were largely freed of government people’s coercion in the American Colonies and in the United States of America in the 1800s. Total taxes as a percentage of GDP in the American Colonies were just 1-2%, and total local, state, and national government revenues as a percentage of GNP in the USA through 1913 were just 4-8% [11]. This transformed small groups of survivors into the greatest engine for human well-being that has ever existed.

When a good constitutional structure and a good party succeed in limiting government people’s size and coercive force, customers and businesspeople will take over and boost economic well-being way better than government people can ever do by political processes.

With these three simple shifts, we can produce three giant leaps that ratchet up freedom.

References

- French, Doug. “The World Is Growing Tired of Government-Controlled Fiat Currencies.” Mises Wire, 23 May 2019, mises.org/wire/world-growing-tired-government-controlled-fiat-currencies. Accessed 20 Nov. 2020.

- Abbott, Robert. “Jeremy Siegel: Stocks for the Long Run.” Marotta on Money, 27 Dec. 2018, www.marottaonmoney.com/wp-content/uploads/2020/05/Jeremy-Siegel-Stocks-for-the-Long-Run.pdf?fbclid=IwAR2OXSwvIOeCN4HjKYUJxYhyRQ5kIjvw31J1HI1LYRikYjuuBmmwP8oP24A#page=3. Accessed 20 Nov. 2020.

- Barnes, Yolanda. “8 Things to Know About Global Real Estate Value.” Savills.com, July 2018, www.savills.com/impacts/market-trends/8-things-you-need-to-know-about-the-value-of-global-real-estate.html. Accessed 20 Nov. 2020.

- “How Much Is the World Worth?” Savills.co.uk, 10 April 2017, www.savills.co.uk/blog/article/216300/residential-property/how-much-is-the-world-worth.aspx#article. Accessed 20 Nov. 2020.

- Klein, Matthew C. “The World’s Forgotten Asset Class.” Barron’s, 7 Sep. 2018, www.barrons.com/articles/the-worlds-forgotten-asset-class-1536345394. Accessed 20 Nov. 2020.

- “Summary of Debt Securities Outstanding. Q1 2018. Level: 4.” BIS.org, stats.bis.org/statx/srs/table/c1?p=20181&c=. Accessed 20 Nov. 2020.

- Desjardins, Jeff. “All of the World’s Money and Markets in One Visualization.” VisualCapitalist.com, 27 May 2020, www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2020/. Accessed 20 Nov. 2020.

- Bacha, Ruzbeh. “What 400 Year History Tells Us About Emerging Asset Classes Including Cryptos.” CityFalcon.com, 2 Dec. 2018, www.cityfalcon.com/blog/investments/what-400-year-history-tells-us-about-emerging-asset-classes-including-cryptos/. Accessed 20 Nov. 2020.

- McMahon, Tim. “Historical Consumer Price Index (CPI-U) Data.” InflationData.com, 12 Nov. 2020, inflationdata.com/Inflation/Consumer_Price_Index/HistoricalCPI.aspx?reloaded=true. Accessed 20 Nov. 2020.

- Anthony, James. “George Washington’s Error and the Corruption of Banking.” American Thinker, 22 May 2019, www.americanthinker.com/articles/2019/05/george_washingtons_error_and_the_corruption_of_banking.html. Accessed 20 Nov. 2020.

- Anthony, James. The Constitution Needs a Good Party: Good Government Comes from Good Boundaries. Neuwoehner Press, 2018, pp. xvii-xix, 211.

James Anthony is the author of The Constitution Needs a Good Party and rConstitution Papers, publishes rConstitution.us, and has written articles in The Federalist, American Thinker, and Foundation for Economic Education. He is an experienced chemical engineer with a master’s in mechanical engineering.

Commenting

- Be respectful.

- Say what you mean.

Provide data. Don’t say something’s wrong without providing data. Do explain what’s right and provide data. It’s been said that often differences in opinion between smart people are differences in data, and the guy with the best data wins. link But when a writer provides data, the writer and the readers all win. Don’t leave readers guessing unless they go to links or references. - Credit sources.

Provide links or references to credit data sources and to offer leads.