You Built That: real Net Voluntary Value Added per capita

We live better to the extent that we voluntarily shop and buy after we voluntarily add value.

James Anthony

September 11, 2020

Source: Anthony 2020 preview, 12.6

Gross Domestic Product gets reported a lot but misleads us about how well we’re living. Let’s fix that.

How to Improve on GDP

GDP’s name focuses us on counting production, and this softens us up to accept counting production of government work (Higgs 1998). An alternative that’s equal (Fox et al. 2019, 2-9) but whose name focuses on what matters to us is Gross Value Added, GVA.

GVA, like GDP, includes value added by us but controlled by government people. Nowadays control by government people means way more government spending (Wallis 2000, 65), government monopolies (Payne 2016, 129-30), government cronies (Edwards 2007), and government restrictions on us (Wayne Crews 2017), all of which make us live worse. We really only live better when the value added by us is controlled by us: when value is added by us voluntarily, and products are then chosen by us voluntarily.

We will correct for government spending being falsely counted as meaning we’re living better (Ilzetzki, Mendoza, and Végh 2013). The value added by us but controlled by national, state, and local government people, G, will be subtracted from GVA, leaving Gross Voluntary Value Added, GVVA.

GVVA, like GVA and GDP, includes purchases that are paid for by adding debt. Debt-fueled purchases let us live better now, but they instantly obligate us to pay back the full principal in the future, which ensures that we’ll live worse in the future. From the start, the purchases’ positive impact and the principal’s negative impact exactly cancel each other, so from the start, debt-fueled purchases leave us no better off. We will correct below for debt-fueled purchases being falsely counted as meaning we’re living better.

Debt also instantly obligates us to pay interest (Bezemer and Hudson 2016), so debt-fueled purchases also make us live somewhat worse. Compared to increases in debt, though, the associated increases in interest payments are one to two orders of magnitude smaller. This small effect can safely be neglected here.

Interest payments increase when interest rates increase. At first we live worse. At the same time, our saving and investing are incentivized, start increasing, and increase our productivity, so later we live better. Still, as just discussed, interest-payment effect are comparatively small in magnitude and so can safely be neglected here. And productivity effects are already measured by GVVA.

GVVA, like GVA and GDP, also ignores depreciation of capital assets, even though capital assets wear out and have to get replaced (Spant 2003). This is why depreciation, D, is what gets subtracted from GDP to leave Net Domestic Product, NDP.

Here, as promised, we will correct for debt-fueled purchases being falsely counted as meaning we’re living better. Also, like for NDP, we will correct for depreciation getting ignored, which gets falsely taken as meaning we’re living better. Debt increases, ΔL, and depreciation, D, will both be subtracted from GVVA to leave Net Voluntary Value Added, NVVA.

NVVA, like GVVA, GVA, and GDP, ignores that to the extent that more money is created, prices artificially rise (Polleit 2020), eventually (Andersson 2011). NVVA also ignores an opposite, helpful effect, now usually overpowered by inflation, that to the extent that productivity increases, prices naturally fall (Salerno 2003).

When product prices artificially rise more than labor prices artificially rise (that is, more than our earnings artificially rise), we live worse. When product prices naturally fall more than labor prices naturally fall (that is, more than our earnings naturally fall), we live better.

Product prices tend to artificially rise more than labor prices artificially rise. Also, labor prices stopped naturally falling long ago, solidifying the Great Depression (Ohanian 2009). Since labor-price changes now are small compared to product-price changes, labor-price-change effects can safely be neglected here.

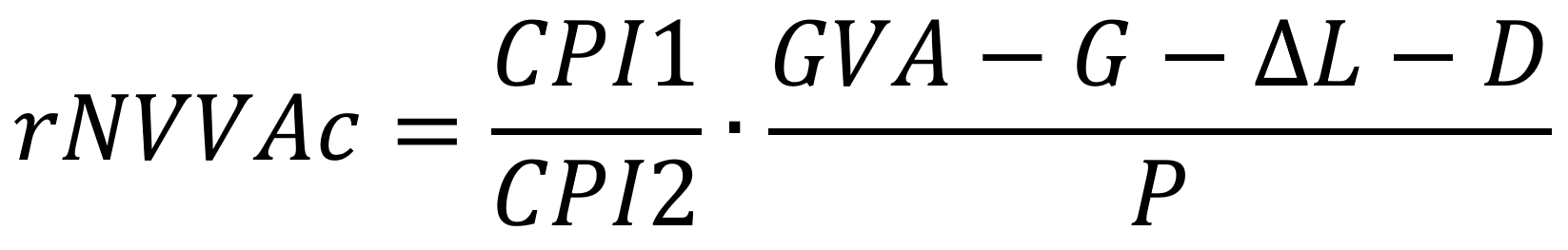

We will account all at once for both our losses from artificial rises in product prices and our gains from natural falls in product prices. NVVA will be multiplied by the ratio of the consumer-price index before and after the product-price changes, CPI1/CPI2, yielding real Net Voluntary Value Added, rNVVA.

Finally, rNVVA, like NVAA, GVVA, GVA, and GDP, ignores that how much better we’re living corresponds not to the value added overall but to the value added per person (Jones and Klenow 2016, 2451). When immigrants add more value, we live better. When immigrants add less value, a larger proportion of the value we add gets taken from us and spent on these immigrants, making us live worse (Horowitz 2019).

We will account all at once for all our gains and losses from population changes. rNVVA will be divided by population P, yielding real Net Voluntary Value Added per capita, rNVVAc.

Meet the New Math

Combining all the improvements settled on above, we will measure how well we’re living by calculating real Net Voluntary Value Added per capita, rNVVAc:

rNVVAc, much-more-closely than GDP, measures our true experiences of living better, stagnating, or living worse.

rNVVAc considers all factors that currently are significant and that currently are estimated in readily-available time series.

Repairs Still Counted as Upgrades

The most-significant factor not corrected in rNVVAc is likely that some value-adding doesn’t make us live better but instead just renormalizes after losses. Repairs—restorations of the previous normal—follow, for example, government-caused wars (Higgs 1992), debt cycles (Salerno 2012), and COVID-19 shutdowns (Hughes 2020); severe storms; metaphorically speaking, all kinds of broken windows (Beattie 2019).

Destructions shrink the current quarter, and repairs swell later quarters.

To avoid counting the value-adding for repairs as gains that make us live better, we would need appropriate time series that capture the amounts and timing of the repairs we make after destructions. Such time series aren’t readily available now.

For now, we need to keep in mind that after destructions, even though we don’t count destructions as losses, we do count repairs as gains. So after destructions, rNVVAc, like GDP, falsely counts the repairs as meaning we’re living better.

Unfortunately, this failure to count our losses gets exactly backwards what matters the most in the long run. Over the centuries, limiting losses, not increasing gains, has been what has accounted for our true progress (Broadberry and Wallis 2017).

A Truer Picture

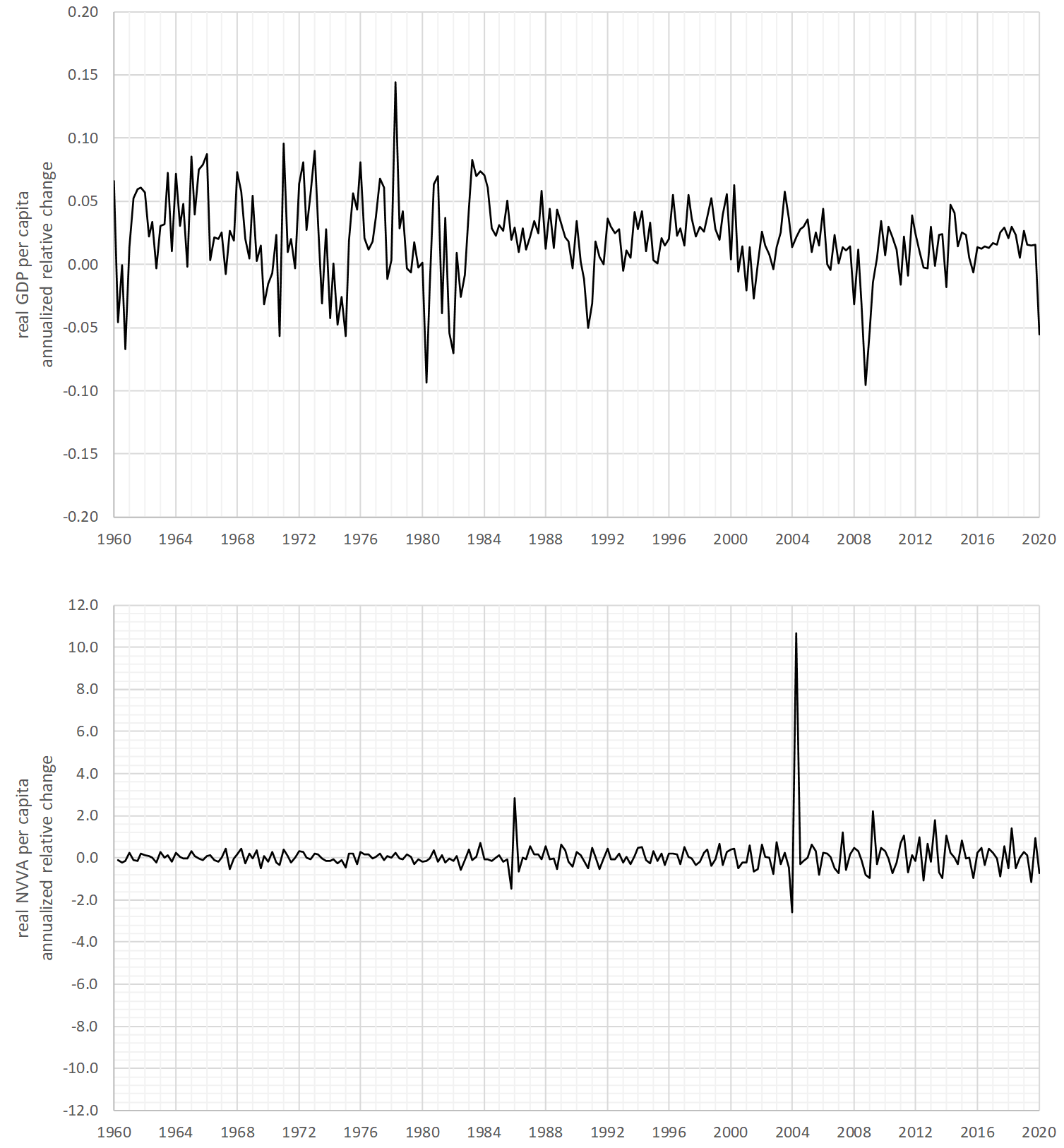

ΔrNVVAc, the relative change in real Net Voluntary Value Added per capita, in the figure’s bottom graph, paints a remarkably-different picture than ΔrGDPc, the relative change in real GDP per capita, in the figure’s top graph.

Figure. Annualized relative change, 1960–2020 Q1, of real GDP per capita and real NVVA per capita. Input data from Federal Reserve Bank of St. Louis (2020b, Real Gross Domestic Product per Capita A939RX0Q048SBEA, All Sectors; Gross Value Added (IMA) Flow ALSGVAQ027S, Government Consumption Expenditures and Gross Investment GCE, State and Local Government Current Expenditures SLEXPND, All Sectors; Total Debt Securities; Liability, Level ASTDSL, Current-Cost Depreciation of Fixed Assets M1TTOTL1ES000, Consumer Price Index: Total All Items for the United States CPALTT01USM657N, Total Population: All Ages including Armed Forces Overseas POP)

It’ll help to start with a little orientation.

In the ΔrGDPc graph on top, an annualized relative change of 0.40 units is plotted as the graph’s full height. In the ΔrNVVAc graph on the bottom, this same annualized relative change of 0.40 units is plotted as the tiny vertical distance between the graph’s finest gridlines. Compared to ΔrGDPc, ΔrNVVAc varies a great deal more.

ΔrGDPc‘s largest peaks and valleys represent far-less change than ΔrNVVAc’s smallest wriggles. Many times, ΔrNVVAc spiked in opposing directions by relatively quite-large amounts. Twice, sizably in 1986 and massively in 2004, ΔrNVVAc spiked first significantly lower and then way higher. As of the latest point shown, 2020 Q1, ΔrNVVAc reversed again, and seriously-bigger losses are already happening (Federal Reserve Bank of New York 2020).

But as always, these current conditions won’t appear in the best-available time series until after long delay times.

Variation Doesn’t Make Control Inaccurate

Surprisingly, increased variation, even of the magnitude seen here, isn’t at all what makes a process variable hard to control. The sole characteristic that makes a process variable hard to control is—wait for it—a relatively-long delay time between when a process variable first starts to change and when the associated process measurement first starts to change enough to be an adequate basis for taking control action (Åström and Hägglund 2006, 26; Smith 2009, 81-5; Smuls 2010). This delay time during which the process measurement effectively is dead silent is called deadtime.

In the macroeconomic nowcasting approaches currently used, the deadtimes for data collection and data reporting are accepted as-is, and then are coarsely mitigated using modeling that’s inadequate because it omits critical debt dynamics (Keen 2014). This systemic measurement deadtime and this modeling inadequacy introduce error that tails off very slowly (Bok et al. 2018).

No more deadtime is introduced when measuring ΔrNVVAc than when measuring GDP. So ΔrNVVAc not only is more valuable to control than GDP but also is equally usable for control by the parties responsible.

Customers Control the Most Accurately

Naturally, which parties are responsible for control in the economy greatly affects how much value we add. Economic control is orders of magnitude faster and more accurate when it’s done not by people in government but by people in business, controlled by freely-choosing customers.

Customers exercise supervisory control relentlessly, using exceedingly-more knowledge, and exceedingly quickly. This makes these customer actions optimally accurate. Through these self-interested actions, customers naturally select the fittest businesses and continually lead them to improve (Anthony 2020 preview, 12.4-16; Von Mises 1944, 20-1; Hayek 1945).

Although variation doesn’t make control harder, variation does increase uncertainty.

Variation Does Cut into Value Added

When we’re subjected to serious variation, we have to pay close attention and make adjustments. All this attention and adjustment takes work. If we could instead use that effort to add more value, we’d all live better. And ΔrNVVAc shows that we’re being subjected to increasing variation by specific actions of government people.

What made ΔrNVVAc so variable in the period shown was a single one of its component factors: changes in debt. Across the best-available time series, short-term changes in every other factor—value-adding, government spending, capital-asset depreciation, product prices, and population—were greatly overshadowed by short-term changes in debt.

ΔrNVVAc’s variation showed that certain of government people’s ham-handed control actions, specifically those actions that changed debt, injected significant uncertainty.

Shining the ΔrNVVAc spotlight on those actions will help us damp down this preventable uncertainty.

Uncertainty increases inefficiency and requires much-more control action.

Being a broad, inclusive category, control inaccuracy/error encompasses malinvestment, which is well described qualitatively (Salerno 2012). Malinvestment itself involves both steady-state error due to seeking suboptimal setpoints and dynamic error in approaching these setpoints. As a category, control error also includes dynamic error in approaching even optimal setpoints.

In malinvestment, the controlling steady-state setpoints are set at suboptimal values by government people. With malinvestments’ suboptimal setpoints and with optimal setpoints alike, setpoints are approached with additional dynamic error. Some additional dynamic error comes from deadtime in measurements, particularly in measurements by government people. Further additional error comes from deadtime and lag in control actions, particularly in control actions by government people. Government work naturally selects for increasing votes, not for increasing value added.

All in all, control errors are principally produced by government people, and control errors underlie not only malinvestment losses but also all manners of losses.

Nothing’s Certain but Debt and Losses

The main overall effects on us are visible in the ΔrNVVAc graph as two features:

- First, ΔrNVVAc started out tamer and ended up more variable. Debt—pushed on us by government people and their cronies (Calomiris and Haber 2014), all of whom we exercised little control over—increasingly ruled how well we were living.

- Second, ΔrNVVAc fell below zero a distressing 50% of the time, with ΔrNVVAc in recent years spending these times even further below zero. Sad and ironic, since, as noted earlier in “Repairs Still Counted as Upgrades,” the key to our long-term growth hasn’t been high growth but rather has been low cumulative shrinkage (Broadberry and Wallis 2017).

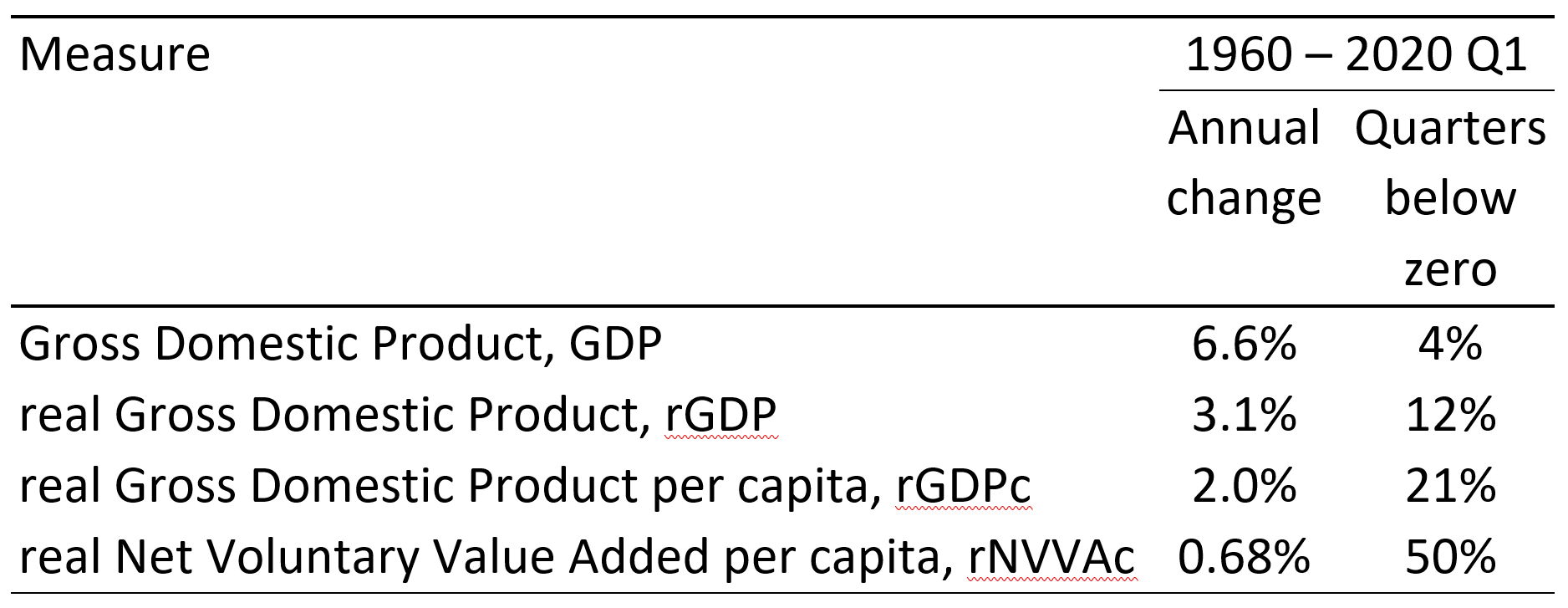

Key characteristics of the graphs are summarized in the table below, together with comparative statistics for simpler related measures.

Table. Annual change and quarters below zero, 1960–2020 Q1, of real GDP per capita and real NVVA per capita.

Compared to GDP and its variants, ΔrNVVAc changed at a rate that much-more-closely reflects our experience—that over our lifetimes, our progress toward living better has been cumulatively very gradual, and has been set back very frequently.

Thankfully, on average from 1960 through 2020 Q1 we lived increasingly well by all measures.

By the politicians’ go-to talking point, GDP, the increase was 6.6% per year. By the more-realistic real GDP, the increase was 3.1% per year. By the government people’s most-candid measure, real GDP per capita, the increase was 2.0% per year. By the far-more-meaningful real NVVA per capita, our true increase was just 0.68% per year.

Tamper-Resistant

Last but great: Unlike the measures proffered by government people, real Net Voluntary Value Added per capita is highly tamper-resistant:

- If government people create money, rNVVAc correctly shows that this government money creation eventually makes us live worse.

- If government people borrow more themselves or push us to borrow more ourselves, rNVVAc correctly shows that this government-controlled debt leaves us no better off.

- If government people spend more, rNVVAc correctly shows that this government spending makes us live worse.

- If government people flood us with lower-value-adding immigrants, rNVVAc correctly shows that this kind of government-controlled immigration makes us live worse.

Yes, we can much-more-closely measure how well we’re living. Let’s do it.

References

Andersson, Fredrik N. G. 2011. “Monetary Policy, Asset Price Inflation and Consumer Price Inflation.” Economics Bulletin 31, no. 1: 759-70.

Anthony, James. 2020. rConstitution Papers: Offsetting Powers Secure Our Rights. St. Peters: Neuwoehner Press.

Åström, Karl J., and Tore Hägglund. 2006. Advanced PID Control. Research Triangle Park: ISA—The Instrumentation, Systems, and Automation Society.

Beattie, Andrew. 2019. “What Is the Broken Windows Fallacy?” Investopedia, July 14. https://www.investopedia.com/ask/answers/08/broken-window-fallacy.asp.

Bezemer, Dirk, and Michael Hudson. 2016. “Finance Is Not the Economy: Reviving the Conceptual Distinction.” Journal of Economic Issues 50, no. 3: 745-68.

Bok, Brandyn, Daniele Caratelli, Domenico Giannone, Argia M. Sbordone, and Andrea Tambalotti. 2018. “Macroeconomic Nowcasting and Forecasting with Big Data.” Annual Review of Economics 10: 615-43.

Broadberry, Stephen N., and John Joseph Wallis. 2017. “Growing, Shrinking, and Long Run Economic Performance: Historical Perspectives on Economic Development.” NBER Working Paper No. 23343. https://www.nber.org/papers/w23343.pdf.

Calomiris, Charles W., and Stephen H. Haber. 2014. Fragile by Design: The Political Origins of Banking Crises and Scarce Credit. Princeton: Princeton University Press.

Edwards, James Rolph. 2007. “The Costs of Public Income Redistribution and Private Charity.” Journal of Libertarian Studies 21, no. 2: 3-20. https://cdn.mises.org/21_2_1.pdf.

Federal Reserve Bank of New York. 2020. “Nowcasting Report.” Accessed July 16, 2020. https://www.newyorkfed.org/research/policy/nowcast.

Federal Reserve Bank of St. Louis. 2020a. “Gross Domestic Product (GDP). Real Gross Domestic Product (GDPC1).” Federal Reserve Economic Data. June 16. https://fred.stlouisfed.org/.

Federal Reserve Bank of St. Louis. 2020b. “Real Gross Domestic Product per Capita (A939RX0Q048SBEA). All Sectors; Gross Value Added (IMA). Flow (ALSGVAQ027S). Government Consumption Expenditures and Gross Investment (GCE). State and Local Government Current Expenditures (SLEXPND). All Sectors; Total Debt Securities; Liability, Level (ASTDSL). Current-Cost Depreciation of Fixed Assets (M1TTOTL1ES000). Consumer Price Index: Total All Items for the United States (CPALTT01USM657N). Total Population: All Ages including Armed Forces Overseas (POP).” Federal Reserve Economic Data. June 16. https://fred.stlouisfed.org/.

Fox, Douglas R., Stephanie H. McCulla, Shelly Smith, and Eugene P. Seskin. 2019. Concepts and Methods of the US National Income and Product Accounts. Washington: Bureau of Economic Analysis. https://www.bea.gov/system/files/2019-12/All-Chapters.pdf.

Hayek, F. A. 1945. “The Use of Knowledge in Society.” The American Economic Review 35, no. 4: 519-30.

Higgs, Robert. 1992. “Wartime Prosperity? A Reassessment of the US Economy in the 1940s.” Journal of Economic History 52, no. 1: 41-60.

Higgs, Robert. 1998. “Official Economic Statistics: The Emperor’s Clothes Are Dirty.” The Independent Review 3, no.1 (Summer): 147-53.

Horowitz, Daniel. 2019. “Just One Year’s Flow of Illegal Immigration Will Cost up to $150 Billion.” Conservative Review, March 8. https://www.theblaze.com/conservative-review/just-one-years-flow-illegal-immigration-will-cost-150-billion.

Hughes, Robert. 2020. “May 2020 Business Conditions Monthly.” American Institute for Economic Research, May 11. https://www.aier.org/article/may-2020-business-conditions-monthly/.

Ilzetzki, Ethan, Enrique G. Mendoza, and Carlos A. Végh. 2013. “How Big (Small?) Are Fiscal Multipliers?.” Journal of Monetary Economics 60, no. 2: 239-54.

Jones, Charles I., and Peter J. Klenow. 2016. “Beyond GDP? Welfare across Countries and Time.” American Economic Review 106, no. 9: 2426-57.

Keen, Steve. 2014. “Modeling Financial Instability.” Debt Deflation (blog), February 1. http://www.debtdeflation.com/blogs/wp-content/uploads/2014/02/Keen2014ModelingFinancialInstability.pdf.

Ohanian, Lee E. 2009. “What–or Who–Started the Great Depression?” Journal of Economic Theory 144, no. 6: 2310-35.

Payne, James L. 2016. “Government Fails, Long Live Government!: The Rise of ‘Failurism’.” The Independent Review 21, no. 1 (Summer): 121-32.

Polleit, Thorsten. 2020. “Fed-Driven Asset Price Inflation Means You Can Now Buy Less House Than You Could Before.” Mises Wire, February 20. https://mises.org/wire/fed-driven-asset-price-inflation-means-you-can-now-buy-less-house-you-could.

Salerno, Joseph T. 2003. “An Austrian Taxonomy of Deflation—With Applications to the U.S.” The Quarterly Journal of Austrian Economics 6, no. 4: 81-109. https://cdn.mises.org/qjae6_4_8.pdf.

Salerno, Joseph T. 2012. “A Reformulation of Austrian Business Cycle Theory in Light of the Financial Crisis.” The Quarterly Journal of Austrian Economics 15, no. 1: 3-44. https://cdn.mises.org/qjae15_1_1.pdf.

Smith, Cecil L. 2009. Practical Process Control: Tuning and Troubleshooting. Hoboken: John Wiley & Sons.

Smuls, Jacques. 2010. “Causes of Dead Time in a Control Loop.” Control Notes (blog), October 18. https://blog.opticontrols.com/archives/235.

Spant, Roland. 2003. “Why Net Domestic Product Should Replace Gross Domestic Product as a Measure of Economic Growth.” International Productivity Monitor no. 7 (Fall): 39-43.

Von Mises, Ludwig. 1944. Bureaucracy. New Haven: Yale University Press.

Wallis, John Joseph. 2000. “American Government Finance in the Long Run: 1790 to 1990.” Journal of Economic Perspectives 14, no. 1: 61-82.

Wayne Crews, Clyde, Jr. 2017. Tip of the Costberg: On the Invalidity of All Cost of Regulation Estimates and the Need to Compile Them Anyway. Washington: Competitive Enterprise Institute. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2502883.

James Anthony is the author of The Constitution Needs a Good Party: Good Government Comes from Good Boundaries, and rConstitution Papers: Offsetting Powers Secure Our Rights. He is a chemical engineer with a master’s in mechanical engineering.

Commenting

- Be respectful.

- Say what you mean.

Provide data. Don’t say something’s wrong without providing data. Do explain what’s right and provide data. It’s been said that often differences in opinion between smart people are differences in data, and the guy with the best data wins. link But when a writer provides data, the writer and the readers all win. Don’t leave readers guessing unless they go to links or references. - Credit sources.

Provide links or references to credit data sources and to offer leads.